Market update in COVID-19 lockdown

14 May 2020

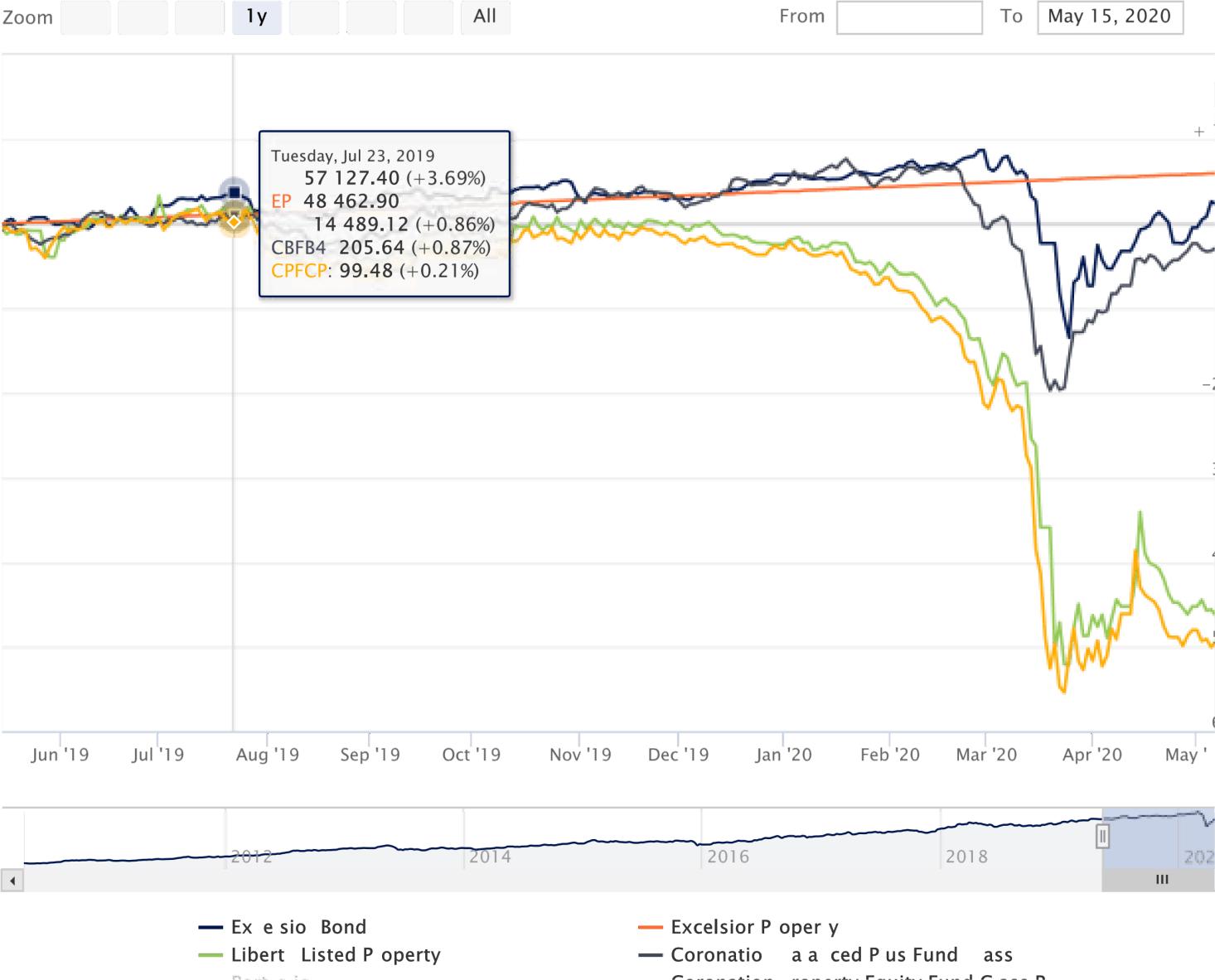

REPORT PERIOD JULY 24, 2019 (HIGHEST POINT IN 12 MONTHS) TO May 14,2020

Coved-19 reaped havoc in the world markets as well as on our returns up to the turning point on March 25th. Some funds even made a profit over the current term.

Looking back, we find that we experienced lower returns since beginning of 2019. I decided to compare the past 12 months returns as an example: